Custom Modeling Services

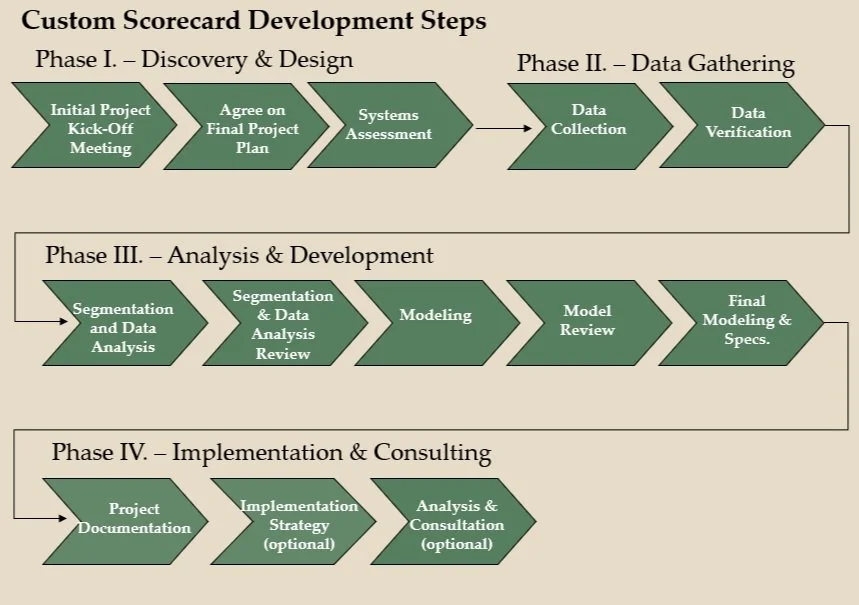

If your company needs Custom Modeling Services, OGMA can provide a multitude of options for model development using proven AI/ML methodologies. We take a step-by-step methodical approach to statistical model development that has proven to be a valuable process to ensure success for any part of the consumer lifecycle. Working directly with your team to understand the business issues at hand, existing policies, and your strategic objectives allows OGMA to provide you with the exact product you need while keeping your team engaged and up-to-date on the model development process. This level of engagement also reduces time and cost by minimizing training on the back end of the project, allowing for immediate implementation by your existing team. Our custom modeling services take a 4-Phase approach:

Phase I– Discovery & Design

Phase II – Data Gathering

Phase III – Analysis & Development

Phase IV – Implementation & Consulting

Learn about our Additional Services here